Cari Blog Ini

Berita Terkini adalah berita Harian kabar terbaru Hari ini di berbagai belahan dunia

Unggulan

- Dapatkan link

- X

- Aplikasi Lainnya

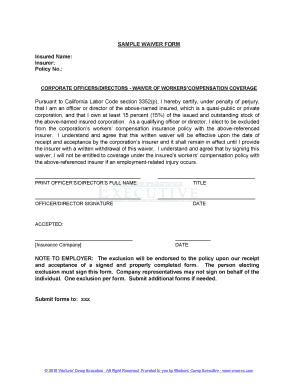

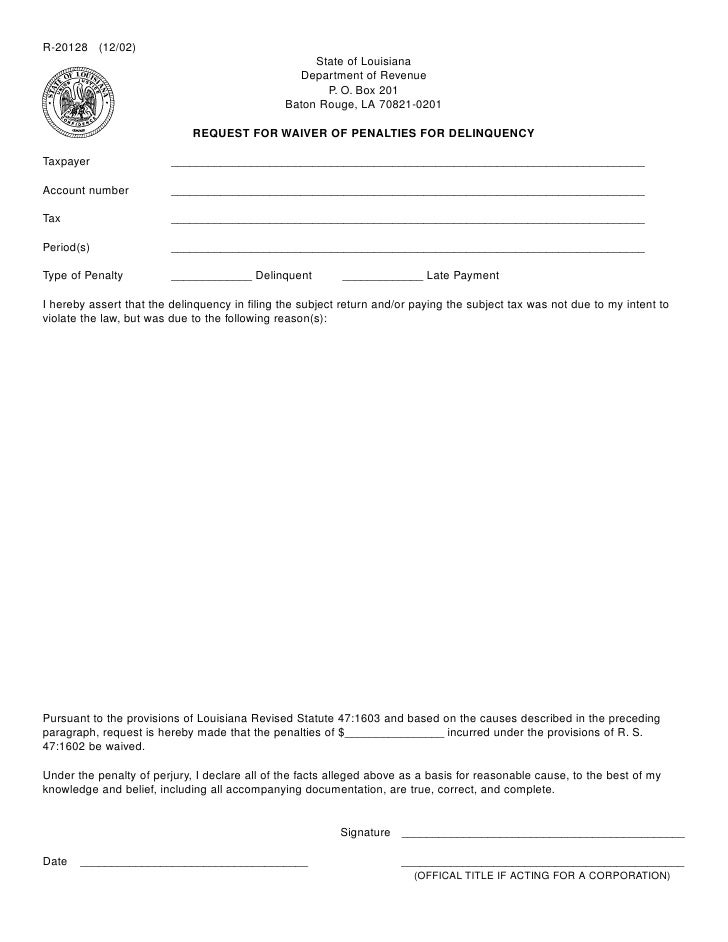

Asking For Waiver Of Penalty - Form DRS-PW Download Printable PDF or Fill Online Request ... / Under 'debt and enforcement', click on 'request for waiver of penalties and interests'.

Asking For Waiver Of Penalty - Form DRS-PW Download Printable PDF or Fill Online Request ... / Under 'debt and enforcement', click on 'request for waiver of penalties and interests'.. Request penalty abatement for my client. Fdor agents are usually advised of the situation and are instructed to waive all penalties caused by the system issue. Finally, if all other means have been exhausted, consider contacting. The cra waived interest on tax debts related to individual, corporate, and trust income tax returns. It is going to take at least a couple of months to resolve the issue.

You didn't previously have to file a return or you have no penalties for the 3 tax years prior to the tax year in which you received a penalty. Kra tax penalty is a fine charged based on the failure of a person to file his or her annual returns, or failing to pay taxes. Dope kenya addresses the following questions; The irs will not waive the penalty on the phone. Are you asking for us to provide you with a draft that you could use to send off to the penalty issuing authority?

Waiver requests for late reports and payments.

The law requires dor to assess a 9% late penalty if the tax due on a return filed by a taxpayer is not paid by the due date. Casualty, disaster) for not complying with the tax laws, you may request a waiver of penalty (abatement of penalty). Hello.,i am working in software company and because of my late opened salary account ,our company hr should draft letter for waiver of interest & penalty against notice and principal to pay? Monthly returns are due on the 25th of the following month. But if done correctly the chance of a first time offender getting the penalty waived is over 90% (at least in my experience). Generally, exemptions from penalty will apply if: Include 80% waiver of estimated tax penalty on line 7. To know whether you have a kra penalty, just log into your kra itax account; Request to waive late fee letter. It's a good idea to take a second look at your return if you have questions about your estimated tax penalty or need help explaining your circumstances to the irs to ask for a waiver or abatement, an. If you still don't qualify for a waiver, you can either use form 2210 to figure the penalty amount or have the irs calculate the penalty and send you a bill. You didn't previously have to file a return or you have no penalties for the 3 tax years prior to the tax year in which you received a penalty. How to apply waiver kra how to pay kra penalties without money kra penalty waiver.

How do i know if my return is on time? The cra waived interest on tax debts related to individual, corporate, and trust income tax returns. A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you. Penalty waiver request, offer of compromise or protest. Interest is never waived unless it was an issue that was caused by fdor.

Under 'debt and enforcement', click on 'request for waiver of penalties and interests'.

The cra waived interest on tax debts related to individual, corporate, and trust income tax returns. In 2017 or 2018, you retired after reaching age 62 or became disabled, and your underpayment was due to reasonable cause (and not willful neglect), or. The irs only removes penalties incurred in the first year. How do i know if my return is on time? Find out about the irs first time penalty abatement policy and if you qualify for administrative relief from a penalty. Fdor agents are usually advised of the situation and are instructed to waive all penalties caused by the system issue. How to apply waiver kra how to pay kra penalties without money kra penalty waiver. If you ask for a waiver for reasonable cause, you need to however, if any penalties are reduced, the related interest is also reduced automatically. The law requires dor to assess a 9% late penalty if the tax due on a return filed by a taxpayer is not paid by the due date. Consequently, cases must be evaluated individually in early 2008, the taxpayer hired an accountant to prepare her 2007 tax return, disclosed the license, and asked the accountant whether she needed. Request to waive late fee letter. The underpayment was due to a casualty, disaster, or other unusual circumstance, and it would be. Did you know you can request a penalty waiver for your client right from your tax professional online services account?

It is going to take at least a couple of months to resolve the issue. Information about making a request to the cra to cancel or waive penalties or interest. Dope kenya addresses the following questions; They always want the request to be in writing. A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you.

There is a monetary limit on a number of penalties that can be removed.

Dope kenya addresses the following questions; In 2017 or 2018, you retired after reaching age 62 or became disabled, and your underpayment was due to reasonable cause (and not willful neglect), or. That said, there is no guarantee that the issuing agency will give in to your request, but it never hurts to ask. Request penalty abatement for my client. Under 'debt and enforcement', click on 'request for waiver of penalties and interests'. The law requires dor to assess a 9% late penalty if the tax due on a return filed by a taxpayer is not paid by the due date. It is going to take at least a couple of months to resolve the issue. Reasonable cause may exist when you show that you used ordinary business care and prudence and. Form 843 cannot be filed electronically. If the waiver is denied, the penalties will be billed at a future date. Include 80% waiver of estimated tax penalty on line 7. Taxpayers do not need to make a request for the cancellation of penalties and interest if the deadlines were met. How do i know if my return is on time?

- Dapatkan link

- X

- Aplikasi Lainnya

Postingan Populer

Oilers Dark Jersey : Edmonton Oilers Monkeysports Uncrested Adult Hockey Jersey / You can't score off ward and cong.

- Dapatkan link

- X

- Aplikasi Lainnya

Pengguna IPHONE wajib tahu ini - Tips membersihkan cache di iphone

- Dapatkan link

- X

- Aplikasi Lainnya

Komentar

Posting Komentar